If your psychotherapy practice bills insurance, the most common scenario is that there is a single insurance company plan covering the client’s services. However, you may occasionally have a situation where the client presents two (in rare cases even THREE!) insurance companies. The ‘lingo’ that’s used to describe this process is called ‘Secondary Insurance Claims or, at times, ‘Tertiary Insurance Claims’.

If you’re new to insurance billing, billing more than one insurance company might feel overwhelming. But understanding a few essential rules can help simplify the process and provide you confidence in managing your billing.

Secondary insurance defined

When a client is covered under more than one insurance company, one of the policies is considered ‘second’ to the other. It’s an additional plan that the client may have on top of their first (primary) policy.

There are several common reasons a person may have two policies - they’re employed, but also have a government plan such as Medicaid, Tricare, or Medicare; they’ve retired from military service and now work in civilian service; or they have insurance from their own employer, but are also be covered under their spouse’s or parent’s plan.

Since the primary policy covers the bulk of the health care costs of a patient, insurance companies have clear rules about which policy will be the primary and which will be secondary. Additionally, they’re going to work hard to ensure that you don’t get paid more than 100% of the bill total through a process called coordination of benefits (COB).

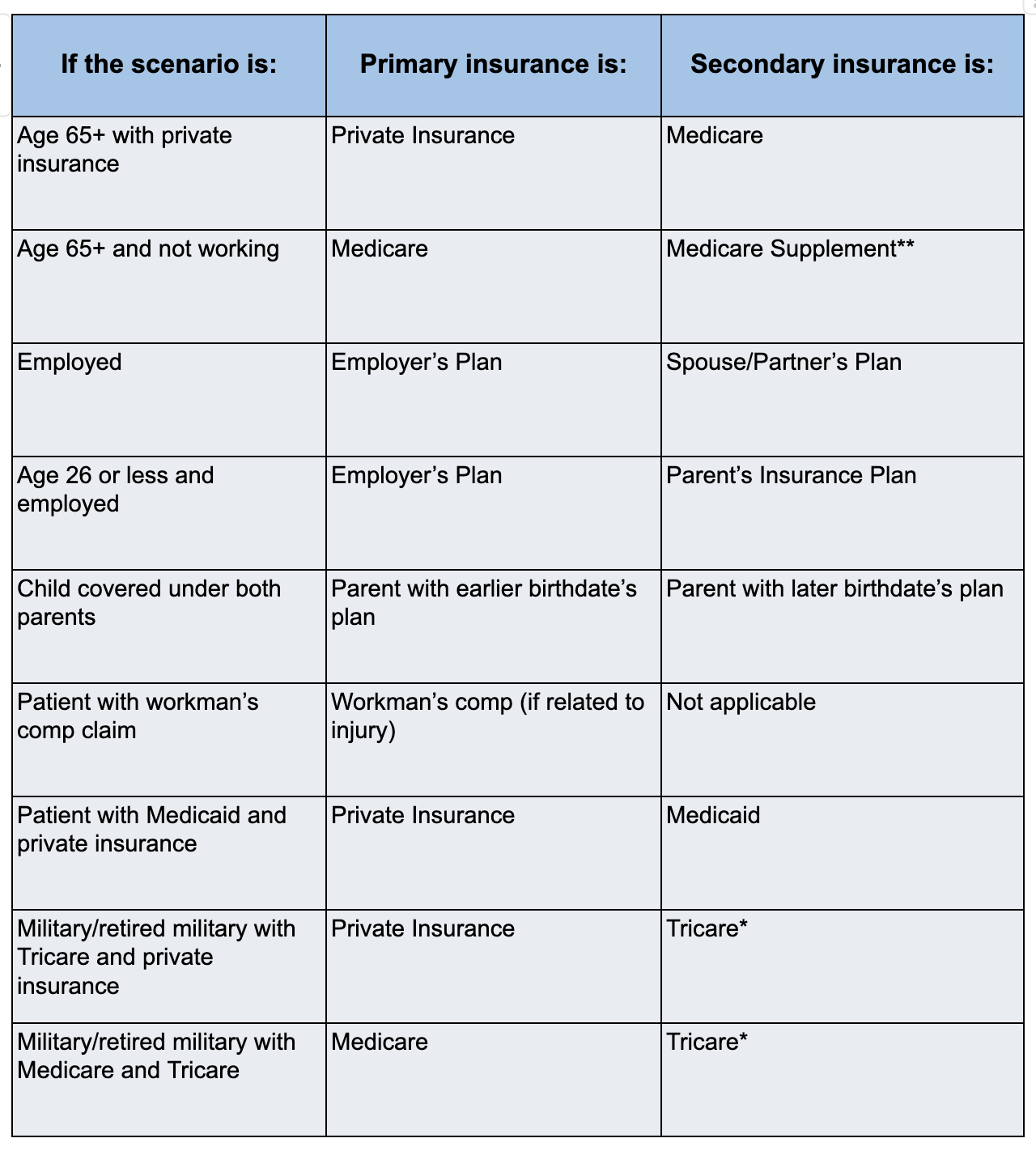

The vast majority of the rules surrounding which insurance company is considered primary and which is secondary are explained in the chart below:

The billing process for primary and secondary insurance

‘Bill Primary Policies First - Bill Secondary Policies AFTER Primary Pays or Denies’

It’s important to know that you don’t submit claims to both the primary and the secondary Insurance at the same time. Instead, follow this process:

- Check eligibility and verify insurance for each of the insurance plans. If neither plan shows up as primary, have the client update the COB with their insurer, which likely requires them to call their insurance company.

- Once the primary insurance is verified, submit the claim to the primary insurance company

- Receive the explanation of benefits from the primary insurance company (payment or denial) and note the allowable amount, the patient responsibility, and any adjustments for your contracted rate. Make a copy of it for the secondary insurance company (redact names of any other clients that might be on the EOB).

- Submit the claim to the secondary insurance company and include a copy of the EOB from the primary insurance claim. There are special fields on the claim forms that designate this claim as a secondary policy.

- Once the secondary insurance pays their portion of the claim, the client is responsible for any remaining balance.

- If you encounter the rare case of the client having three insurance companies (and none are a Medicare Supplement Company), if the claims are not paid in full after receiving payment from the secondary – submit to the tertiary insurance company and wait for their response before requiring the patient to pay the balance.

What if I’m not in-network with both insurance companies?

Occasionally, you may not be in network with one of the two insurance companies. In these cases, you will need to refer to the chart below to understand the process.

Additional details:

- If there is a deductible that has not yet been met on the primary insurance, the secondary insurance will not cover it. There is no need to submit a claim to the secondary insurance company until after the primary deductible is met.

- If Tricare is secondary to Medicare, Tricare will cover deductibles for services covered by both Medicare and Tricare.

- If the primary insurance is Medicare and the secondary insurance is a Medicare supplement, there’s typically no need to create a secondary insurance claim. Medicare will automatically forward the COB to the supplement for you.

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript